American Lithium Minerals (OTCID:AMLM) announced it has taken a 19 percent stake in privately held Cunningham Mining, giving it exposure to precious metals in BC’s Golden Triangle.

The acquisition gives the explorer an indirect interest in Cunningham’s Nugget Trap placer claims, a 573.7 acre property registered with the BC Mineral Title registry and located within the Skeena Mining Division.

The transaction adds a permitted gold project to American Lithium’s growing property portfolio as it seeks to diversify across gold, lithium, rare earths and other critical minerals.

According to the company, Nugget Trap is authorized for a pay mining program of up to 30,000 cubic yards per year under permits issued by the BC’s Ministry of Mining and Critical Minerals.

A recent independent assay based on a 25 pit test program reported average grades of more than 25.54 grams of gold per cubic meter, along with recoverable silver. The company attributes the mineralization to large gold and copper systems located upstream, including the Mitchell, Sulphurets, Kerr and Snowfield deposits.

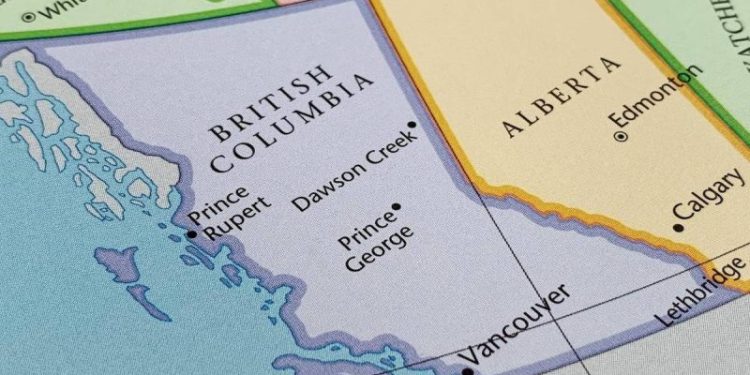

Located in Northwestern BC, the Golden Triangle has drawn renewed industry attention amid higher gold prices and expanding infrastructure. The area is home to Seabridge Gold’s (TSX:SEA,NYSE:SA) KSM project, which the company says is one of the world’s largest undeveloped gold deposits by reserves. An updated preliminary feasibility study for KSM outlines proven and probable reserves of 47.3 million ounces of gold and 7.3 billion pounds of copper.

The Nugget Trap interest helps to geographically diversify American Lithium’s asset base, which also includes silver, copper-gold, rare earths and polymetallic projects in Chile, Québec, Yukon and Nevada.

Among those is the Sarcobatus lithium property in Central Nevada, covering roughly 1,780 acres of mining claims.

Alongside the Cunningham deal, the company announced the appointment of Ryan Cunningham as president and CEO of its wholly owned subsidiary, American Mineral Resources.

American Lithium said it continues to pursue financing and additional acquisitions to advance its exploration assets.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.